Why Gibraltar?

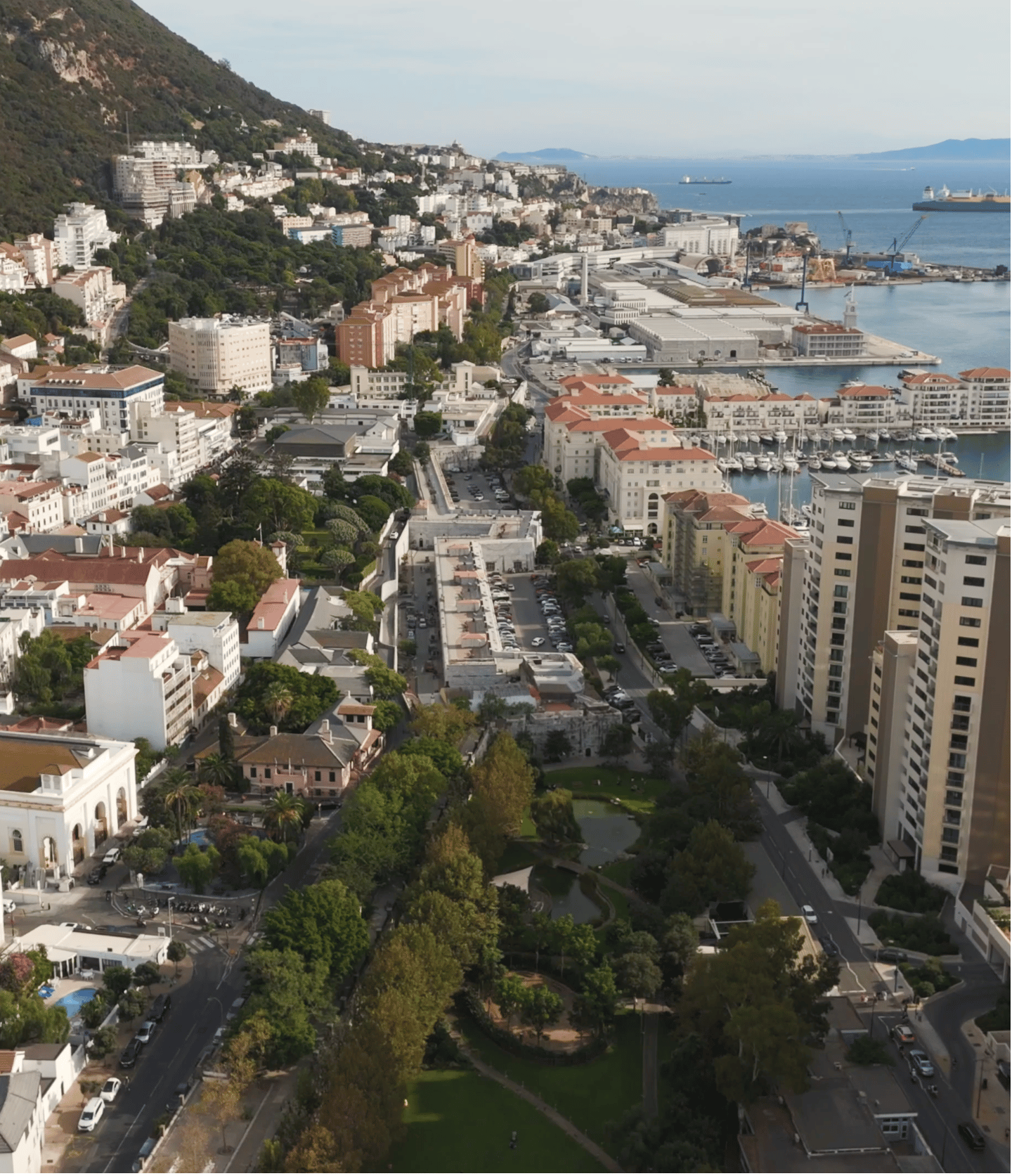

Gibraltar’s unique blend of Mediterranean charm and favourable tax environment makes it an appealing destination for those looking to relocate or invest abroad.

Tax Efficiency

12.5 % corporate tax on local profits—and no inheritance, gift, capital-gains, wealth, or offshore-income taxes.

Reliable Framework

English common law and UK-equivalent regulation deliver clarity, confidence, and first-class investor protection.

Mediterranean Lifestyle

300 days of sunshine, English-speaking services, and UK-style education and healthcare—seamless living on Europe’s southern tip.

Gibraltar Residency: At-a-Glance Routes

1. Category 2 — High-Net-Worth Status

For individuals with £2 million+ in verifiable assets.

Taxed only on the first £118 k of income (annual liability £37-£44.7 k).

No minimum day-count; certificate is reviewable but lifelong.

Must rent / buy an approved home and hold private medical insurance.

2. HEPSS — Specialist Executive Certificate

For senior professionals earning £160 k+ whose skills drive Gibraltar’s economy.

Income capped at £160 k for tax (fixed charge £43,140).

Requires an executive role, qualifying accommodation and no recent Gibraltar residency.

3. Ordinary Residence & Employment

Live or work in Gibraltar for 183 days a year (or 300 days over 3 years) to become ordinarily resident; tax then follows the standard Gross- or Allowances-Based system.

Applies to employees, self-employed and entrepreneurs holding the relevant work permits.

4. Self-Sufficient & Retiree Permit

Available to those who can prove adequate income or pension plus comprehensive private health insurance.

Buying Process — Key Facts

1. Ownership Structures

Freehold – rare and mainly inside the old City Walls; you own both land + building in perpetuity.

Leasehold – the norm in Gibraltar’s apartment blocks; long leases (typically 99 or 149 years from the original developer’s head-lease) spell out owner and management obligations in detail.

2. How a Purchase Unfolds

Agent finds the property and issues a memorandum of sale marked subject to contract.

You instruct an independent lawyer (never the seller’s) to protect your interests.

A 2 % holding deposit is lodged with the agent; only then do formal enquiries and contract drafting begin.

3. Pre-Deposit Checklist

Before wiring that 2 %, confirm:

Tenure clarity — freehold or remaining lease term and any ground rent.

Service-charge exposure — annual fees, reserve funds and upcoming works.

Usage or alteration limits — restrictions in the lease or title that could affect future plans.